When it comes to saving money on life-saving biologic drugs, biosimilars are one of the biggest tools in modern healthcare. But if you compare how Europe and the United States handle them, you’ll see two completely different stories. Europe has been using biosimilars for nearly two decades. The US? It’s just starting to catch up - and fast.

What Exactly Are Biosimilars?

Biosimilars aren’t generics. That’s the first thing to understand. Generics are exact copies of small-molecule drugs like aspirin or metformin. Biosimilars, on the other hand, are highly similar versions of complex biological drugs - things like Humira, Enbrel, or Rituxan. These are made from living cells, not chemicals. Even tiny changes in the manufacturing process can affect how they work. That’s why regulators require extensive testing to prove biosimilars are just as safe and effective as the original.

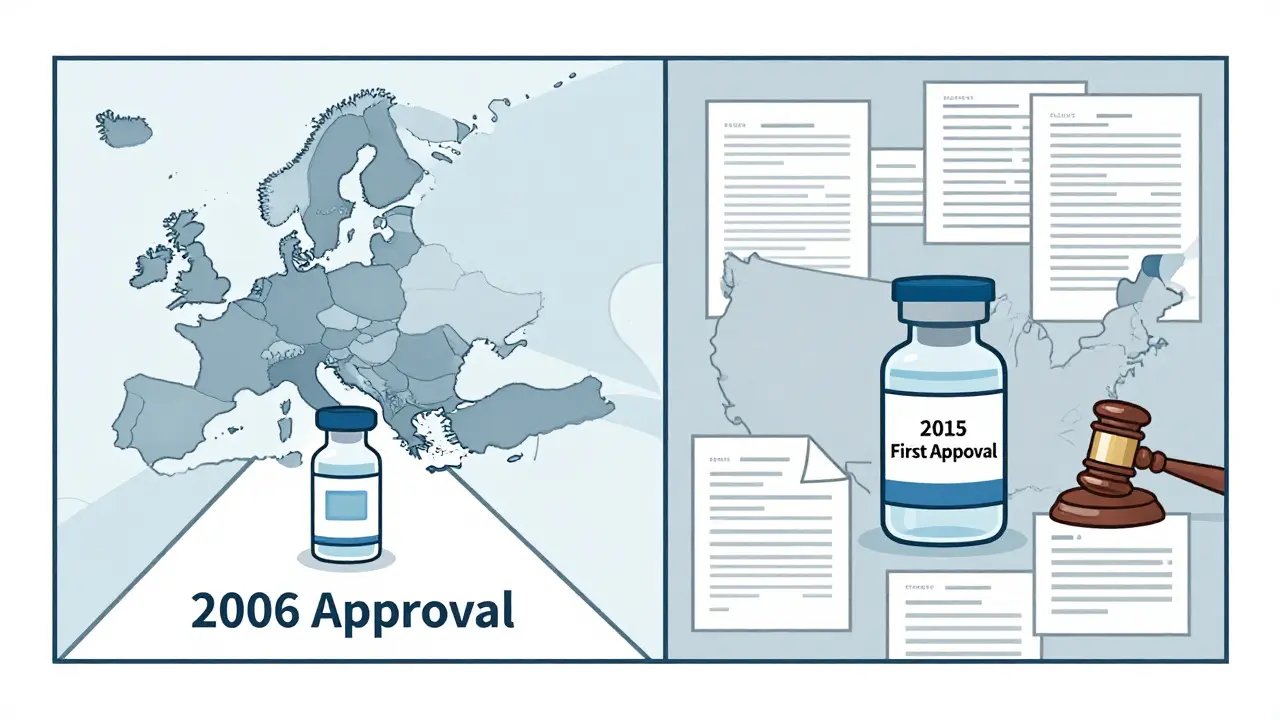

The first biosimilar ever approved anywhere was Omnitrope, a growth hormone, in Europe back in 2006. It set the template. Since then, over 100 biosimilars have been approved across the EU. The US didn’t approve its first until 2015: Zarxio, a biosimilar to filgrastim used to boost white blood cells after chemotherapy.

Europe: The Pioneer with a Mature System

Europe didn’t just get there first - it built the playbook. The European Medicines Agency (EMA) created a clear, science-based pathway for biosimilar approval in 2006. They didn’t demand endless new clinical trials. Instead, they used a “totality-of-evidence” approach: comparing molecular structure, biological activity, and safety data from existing studies. If the data showed no meaningful difference, approval followed.

That clarity made all the difference. Hospitals in Germany, France, and the UK started using biosimilars in routine care within years. Payers pushed for them because they cut costs by 15-30%. In some countries, substitution is mandatory - pharmacists can switch a patient from the brand-name drug to a biosimilar without asking the doctor.

By 2024, Europe’s biosimilar market hit $13.16 billion. Oncology and rheumatology led the way. In Germany, biosimilars now make up over 80% of the market for certain monoclonal antibodies used to treat rheumatoid arthritis and Crohn’s disease. Sandoz, Fresenius Kabi, and Amgen became giants here, not just because they made good products, but because the system rewarded them for doing so.

The United States: Slow Start, Now Speeding Up

The US passed the Biologics Price Competition and Innovation Act (BPCIA) in 2009 - seven years after Europe. But it took six more years just to get the first biosimilar approved. Why? Patent lawsuits. Originator companies used every legal trick to delay competition. The “patent dance” - a complex, often adversarial process built into the law - became a roadblock. Many biosimilars sat on the shelf, waiting for court rulings.

Even after approval, adoption was sluggish. Doctors were hesitant. Pharmacies didn’t stock them. Insurers didn’t prioritize them. The FDA required switching studies - clinical trials proving patients could safely switch from the original drug to the biosimilar - to qualify for “interchangeable” status. That meant extra time, extra cost, and fewer biosimilars reaching the market.

By 2024, the US had only approved about 20 biosimilars - and only a fraction were actually being used. The market was worth $10.9 billion, still behind Europe. But the tide turned in June 2024. The FDA dropped the requirement for switching studies to get interchangeable designation. That change alone could unlock dozens of new biosimilars in the next two years.

Why the US Is Now Catching Up Fast

Two things are driving US growth: money and patents.

First, the Inflation Reduction Act of 2022 forced Medicare Part D to cap out-of-pocket drug costs for seniors. That made biosimilars more attractive - not just for savings, but for patient affordability. If a biosimilar costs half as much, and patients pay less, everyone wins.

Second, the patent cliffs are here. Humira (adalimumab), the world’s top-selling drug for years, lost exclusivity in 2023. Fourteen biosimilars were approved for it in the US. Six were launched. More are coming. Humira alone is a $20 billion market. When biosimilars take even 50% of that, the ripple effect is massive.

Pfizer, Merck, and Samsung Bioepis are now investing heavily. The FDA’s new rules mean biosimilars can reach the market faster. Analysts now project the US market will hit $30 billion by 2033 - growing at 18.5% per year. Europe’s growth is strong too - around 17.3% - but it’s starting from a higher base.

Regulatory Differences That Still Matter

Even with recent alignment, key differences remain.

In Europe, the EMA approves a biosimilar once, and then each country sets its own price and reimbursement. That gives national health systems flexibility to negotiate aggressively. Germany, for example, uses hospital tenders - if a biosimilar offers the best price, it gets the contract.

In the US, approval is federal (FDA), but coverage depends on private insurers, Medicare, and Medicaid. That creates a patchwork. A biosimilar might be approved but not covered by your plan. Or it might be covered but require prior authorization. It’s messy.

Also, Europe has decades of real-world data on biosimilar safety. Millions of patients have used them. US doctors are still learning. But with more biosimilars entering the market and more data emerging, that gap is closing fast.

Who’s Winning?

Right now, Europe still leads in total market size and adoption rate. But the US is growing faster. By 2027, North America could overtake Europe in biosimilar revenue, according to Grand View Research.

Europe’s strength is its consistency. It built a system that works. The US’s strength is its scale. With a bigger economy, more high-value biologics coming off patent, and now smarter regulations, the US has the potential to dominate the next decade.

The real winner? Patients. And healthcare systems. Biosimilars are cutting costs without cutting care. In Europe, they’ve saved billions. In the US, they’re about to do the same.

What’s Next?

Next-generation biosimilars are coming - for complex conditions like diabetes, multiple sclerosis, and rare diseases. Manufacturing them is harder. But the lessons from Europe and the momentum in the US mean both markets are better prepared than ever.

One thing’s clear: biosimilars aren’t a flash in the pan. They’re the future of affordable biologic therapy. And whether you’re in London or Los Angeles, you’ll be seeing more of them - and paying less for them - in the years ahead.

Are biosimilars the same as generics?

No. Generics are chemically identical copies of small-molecule drugs. Biosimilars are highly similar versions of complex biologic drugs made from living cells. They can’t be exact copies because of their complexity, but they must show no clinically meaningful differences in safety, purity, or effectiveness compared to the original.

Why did Europe adopt biosimilars faster than the US?

Europe created a clear, science-based regulatory pathway in 2006 and encouraged adoption through hospital tenders, mandatory substitution in some countries, and payer incentives. The US faced legal barriers like patent lawsuits and a more fragmented healthcare system. The FDA also required costly switching studies until 2024, which slowed approval.

Which countries in Europe lead in biosimilar use?

Germany, France, and the UK are the leaders. Germany, in particular, is a manufacturing hub and has some of the highest adoption rates - especially in oncology and autoimmune diseases. Hospital procurement systems and price negotiations have driven uptake across these nations.

What changed in the US in 2024 to boost biosimilar adoption?

In June 2024, the FDA removed the requirement for switching studies to qualify a biosimilar as “interchangeable.” This meant manufacturers could bring biosimilars to market faster and cheaper. Combined with the Inflation Reduction Act’s drug cost caps, this created a major turning point for adoption.

Will biosimilars replace original biologics entirely?

Not entirely, but they’ll take a large share. In Europe, some biosimilars already hold over 80% of the market for certain drugs. In the US, as more patents expire and barriers fall, we’ll see similar shifts - especially for high-cost drugs like Humira, Enbrel, and Rituxan. The goal isn’t to eliminate originals, but to offer cheaper, equally safe alternatives.

Are biosimilars safe?

Yes. Biosimilars undergo rigorous testing to prove they’re as safe and effective as the original biologic. In Europe, over 100 biosimilars have been used by millions of patients for nearly 20 years with no new safety concerns. The FDA and EMA both require extensive data before approval.

Harriet Hollingsworth

January 1, 2026 AT 11:29So Europe just got lucky with their system and now they're acting like they invented medicine? 🙄

Stewart Smith

January 2, 2026 AT 10:02Meanwhile in the US, we spent 15 years arguing over who owns the patent to a protein and now we're catching up. Classic.

At least the FDA finally stopped making manufacturers jump through 17 hoops just to save people money.

Lawver Stanton

January 3, 2026 AT 09:53Let me tell you something-this whole biosimilar thing is a corporate scam dressed up as healthcare reform. The big pharma companies in Europe? They’re the same ones that priced Humira at $70,000 a year for a decade. Now they’re selling biosimilars for $40,000 and calling it a win? Please. The real win is the shareholders getting a 300% ROI while patients still can’t afford insulin. And don’t get me started on how the FDA’s ‘interchangeable’ label is just a fancy way of saying ‘we trust you not to kill anyone’-which, honestly, is not a high bar when you’ve got 20 years of European data proving it’s safe. Meanwhile, doctors in the US are still scared to switch patients because they don’t want to be the one who gets sued when someone’s kidney flakes out. And yeah, I know it’s not the biosimilar’s fault-but the system? The whole damn system is rigged to keep profits high and patients guessing. We didn’t need a new FDA rule-we needed a new moral compass.

anggit marga

January 3, 2026 AT 22:22Europe thinks they're so advanced but they're just using cheap labor and state control to force adoption

US is doing it right-letting market forces decide not bureaucrats

Aaron Bales

January 4, 2026 AT 08:19Real talk: biosimilars aren’t magic. They’re science. And the US is finally doing the science right.

Patent dances? Over. Switching studies? Gone.

Now let’s get them into clinics.

Brandon Boyd

January 5, 2026 AT 10:02Big win for patients everywhere. This is how innovation should work-fast, fair, and focused on people, not lawsuits.

Keep pushing, US. You’re doing great.

Joy Nickles

January 5, 2026 AT 21:27wait so… the FDA just said ‘whatever’ about switching studies??

so like… no more testing??

are we just… trusting them now??

like… what if someone gets a rash??

who pays for that??

and why is everyone acting like this is a miracle??

it’s just… lazy regulation??

and why is this even news??

we’ve had biosimilars in europe for 20 years…

we’re just catching up??

…i’m confused…

and also… who’s gonna explain this to my grandma??

she’s on 3 biologics and she still thinks ‘generic’ means ‘fake’

and i’m not even kidding…

she asked me last week if biosimilars are ‘like knockoff handbags’

…i cried.

…i’m still crying.

Emma Hooper

January 6, 2026 AT 18:44Europe didn’t ‘win’-they just had the decency to stop treating patients like ATM machines.

Meanwhile, the US spent two decades letting lawyers draft healthcare policy while people went bankrupt for insulin.

Now we’re finally catching up… but only because the math forced us to.

Not because we cared.

Because we had to.

And honestly? That’s the saddest part.

Sara Stinnett

January 6, 2026 AT 19:50Oh please. You call this progress? Europe’s ‘mature system’ is just state-run price suppression masquerading as science. The FDA didn’t ‘catch up’-they surrendered to political pressure. And now we’re going to let pharmacists swap out biologics like they’re switching brands of toilet paper? What’s next? Replacing heart valves with ‘biosimilar’ versions from a factory in Bangalore? The EMA’s ‘totality of evidence’ is a euphemism for ‘we don’t have the bandwidth to test properly.’ Meanwhile, American doctors are being trained to trust a molecule that’s 98% identical and call it ‘clinically equivalent.’ That’s not science. That’s gambling with human lives. And don’t even get me started on how ‘interchangeable’ is just corporate-speak for ‘we’re too lazy to monitor outcomes.’ This isn’t innovation-it’s systemic negligence dressed in regulatory glitter.

Jenny Salmingo

January 8, 2026 AT 03:40As someone who’s watched my mom go through rheumatoid arthritis treatment for 12 years-this is huge.

She’s been on Humira since 2012.

She’s had three different biosimilars since 2020.

No side effects. Same results.

Her copay dropped from $1,200 to $45.

That’s not policy.

That’s dignity.

Thank you, Europe-for showing us how.

Thank you, US-for finally listening.

linda permata sari

January 9, 2026 AT 02:19OMG I JUST REALIZED WE’RE LIVING IN THE FUTURE 😭

BIOSIMILARS ARE LIKE THE AVENGERS OF MEDICINE-SAME POWER, LESS MONEY 🦸♀️💊

EUROPE DID IT FIRST, BUT NOW THE US IS FLYING 🚀

MY DAD JUST SWITCHED TO A BIOSIMILAR AND SAID ‘I FEEL LIKE I WON THE LOTTERY’ 💰❤️

WE’RE ALL WINNERS HERE 🌍💙

Martin Viau

January 9, 2026 AT 13:02Let’s be real-Europe’s dominance isn’t about regulation. It’s about cultural collectivism. They don’t care about corporate patents. They care about public health. Meanwhile, the US still treats medicine like a Netflix subscription-pay extra for the premium version, or suffer. Biosimilars aren’t a breakthrough. They’re a correction. And the fact that it took us 18 years to get here? That’s not incompetence. That’s greed with a law degree.

Retha Dungga

January 11, 2026 AT 02:38life is a biosimilar of itself

we all try to copy the original but we're just close enough to work

and somehow that's enough

the universe doesn't need perfection

just enough similarity to keep going

so yeah

biosimilars are just like us

not exact

but still alive

still healing

still here

❤️

Robb Rice

January 12, 2026 AT 07:52Just to clarify: the FDA’s removal of switching studies doesn’t mean no testing. It means they’re relying on the existing global data-over 20 years of real-world use in Europe, Asia, and Canada. That’s not laziness. That’s evidence-based efficiency. We’re not cutting corners. We’re finally stopping the unnecessary ones.